Table of Contents

- 001-AUSTRALIAN INDIVIDUAL INCOME TAX RATES 2023 / 24 - YouTube

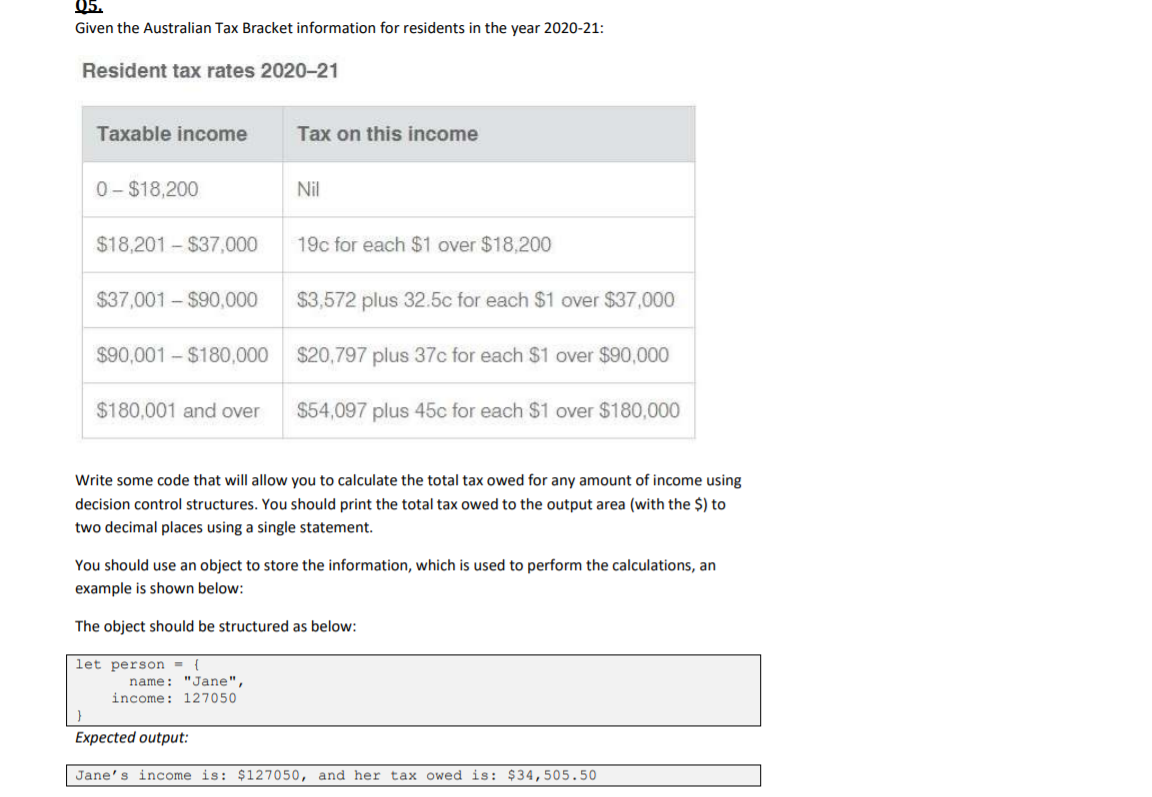

- Solved 05. Given the Australian Tax Bracket information for | Chegg.com

- What Are The Australian Income Tax Rates For 2024 25 - Printable ...

- Marginal Income Tax Rates Archives | Tax Foundation

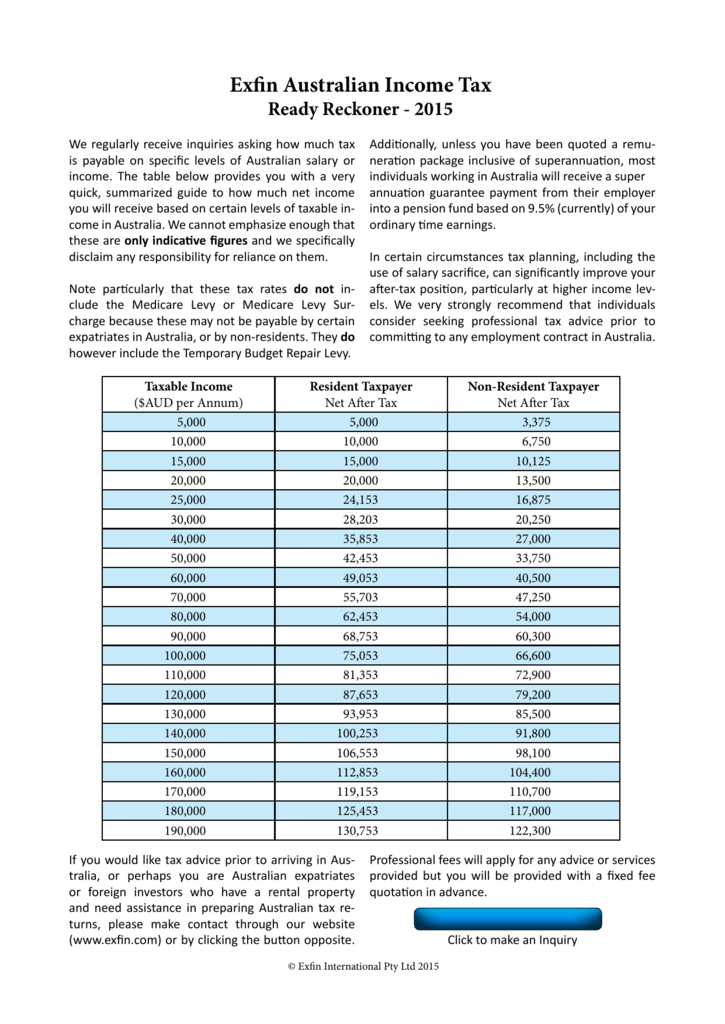

- Tax Planning is for Individuals also…not just for business

- Australia Income Tax Rate 2024 - Shae Yasmin

- Understaing the Australian Tax Brackets and Rates

- Tax Brackets in Australia for 2022

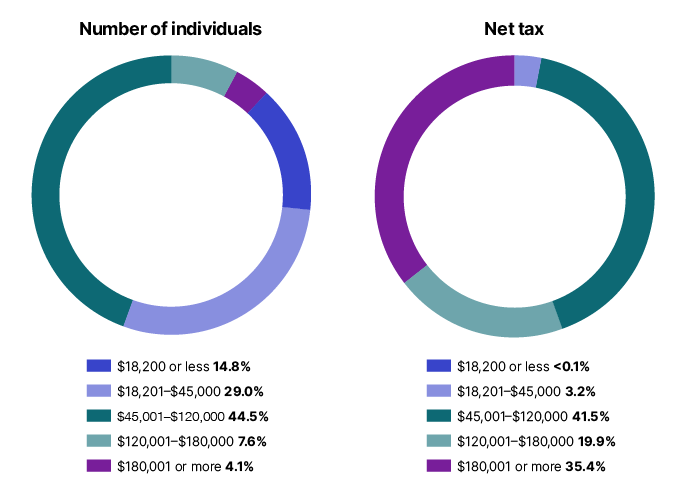

- Individuals statistics | Australian Taxation Office

- Latest estimates and trends | Australian Taxation Office

Understanding the 2025 Australian Tax Changes

Implications for Individuals

Implications for Businesses

For businesses, especially small and medium-sized enterprises (SMEs), the changes could be significant: - Competitiveness: A reduced corporate tax rate could enhance the competitiveness of Australian businesses in the global market. - Investment and Growth: More favorable tax conditions could encourage investment, leading to business expansion and job creation. - Compliance: Businesses will need to ensure they understand and comply with any new tax laws and regulations, which could involve updating accounting systems and processes.